Completion Date:

Project Overview

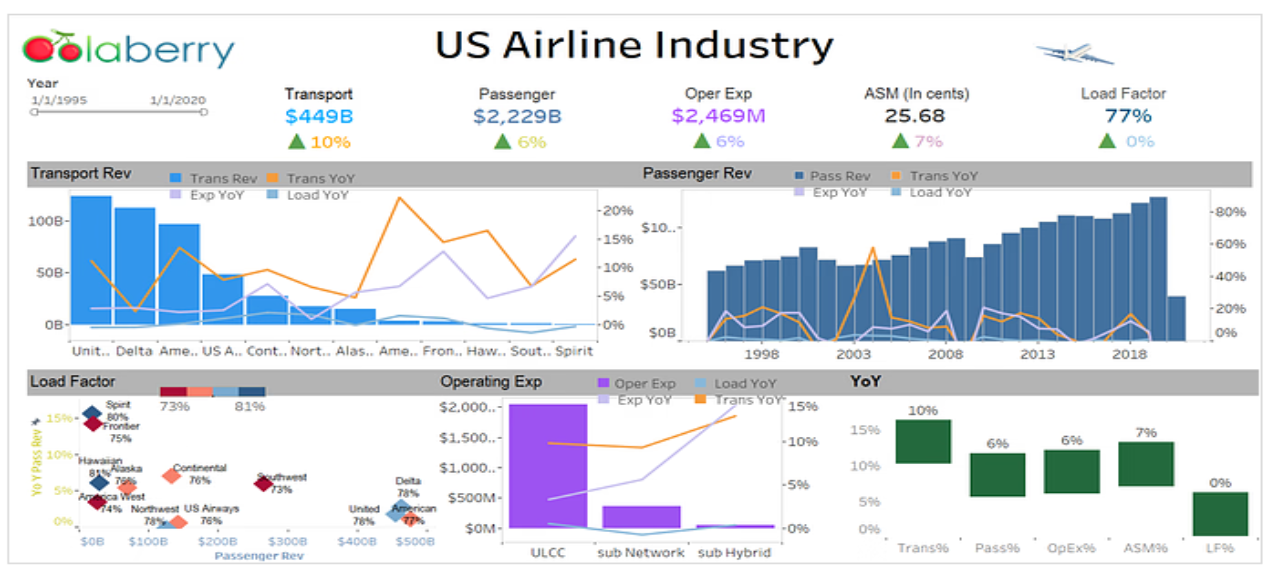

Rising to Success or Meeting Challenges: Navigating the Complexities of the US Airline Industry. The US airline industry represents a multifaceted and continually evolving landscape of competition, diversity, and regulatory demands, requiring substantial investments in both capital and labor. This dynamic sector remains susceptible to external economic factors and shifting market trends, even in the post-deregulation era. Given the pivotal role airlines play in connecting people and businesses globally, it is crucial for investors seeking to improve their financial performance to conduct a comprehensive and insightful analysis of this intricate terrain.

Role:

Problem Statement

Airlines worldwide found themselves unprepared for the crisis, given the decade-long streak of positive trends in airline net profits, geopolitical stability, and continuously increasing demand for air travel. As of the close of 2019, the U.S. airline industry had been basking in historic levels of profitability. The six largest U.S.-based airlines, including Delta, American, United, Southwest, Alaskan, and JetBlue, collectively reported revenues exceeding $175 billion, coupled with a combined operating income of nearly $19 billion and manageable debt levels (Shaked and OrelowItz, 2020). However, the impact of the pandemic was so severe that the airlines\\\' once-promising financial outlooks rapidly eroded. Shortly after the pandemic\\\'s onset, the loss of gross operating revenue was estimated to be between $112 billion and $135 billion (ICAO, 2020).

Next Steps

.

Deployment