Completion Date:

Project Overview

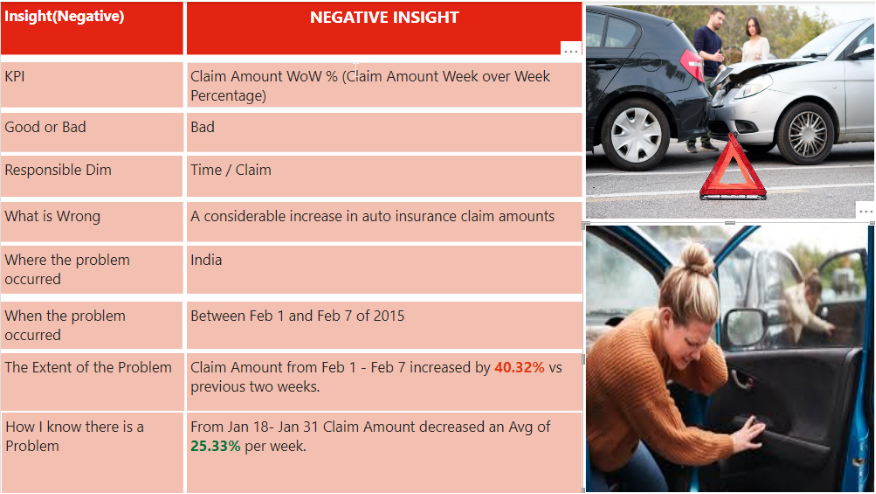

Here\'s one way to make money. Members of an auto insurance would drive into each other\'s cars and receive settlements by claiming that they\'d lost control of their vehicles because they spilled hot coffee on themselves. India forensic has come up with exclusive research and brought forward the quantum of losses in Insurance Sector. According to this Research, the Insurance Sector in India loses 30401 Crore of rupees ($369,746,038) every year due to frauds! In other words, every insurance company loses 8.5% of its revenues to fraud. Since the Insurance sector plays a dynamic role in the wellbeing of its economy, we must find a solution.

Role:

Problem Statement

Although no comprehensive study of losses in the insurance industry has been conducted, best estimates indicate that 15 percent or more of all insurance premiums are lost to fraud; with yearly premiums exceeding $200 billion, this amount could produce $30 billion a year in fraudulent claims.

The Insurance sector in India loses 30,401 Crore of rupees approximately USD 414 million every year due to frauds! In other words, every insurance company loses 8.5% of its revenues to the fraud. Financial year end, March 2022, there was a loss of INR (Indian Rupee) 12 billion or approximately USD 164 million due to motor vehicle insurance frauds. Alarming as it is, merely 0.5% of insurance fraud cases are investigated which results in a loss ratio of around 4%-4.5%.

Next Steps

skip

Deployment

skip