Project Overview

Investing in stocks has risk, when someone is putting their hard-earned money into a stock, they need to research if it is profitable.

Stock research is very important. A few hours researching a company\\\'s operating history and industry environment could avoid significant future losses. Evaluating the past few years of the company\\\'s growth can give some insight into decision making.

Profitability and liquidity are some of the key indicators for researching stocks. Profitability and liquidity signal financial strength or weakness.

This analysis will be done on Amazon stock from year 2015 to 2020. Amazon.com, Inc. engages in the retail sale of consumer products and subscriptions in North America and internationally. It operates through the North America, International, and Amazon Web Services (AWS) segments

This analysis will help both investors and companies, Investors buy stock to earn a return on their investment. And increased stock price reflects companies overall financial health

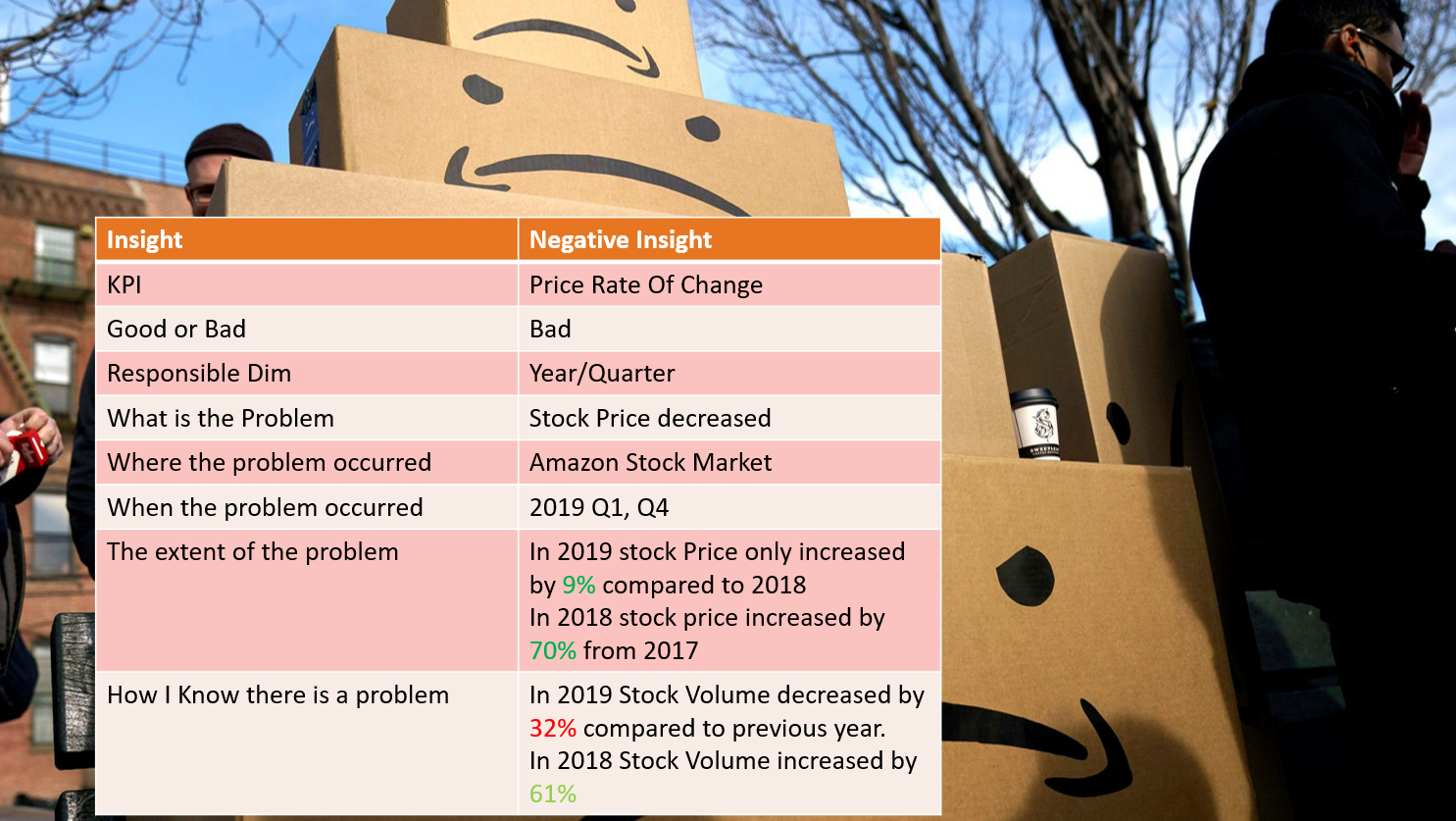

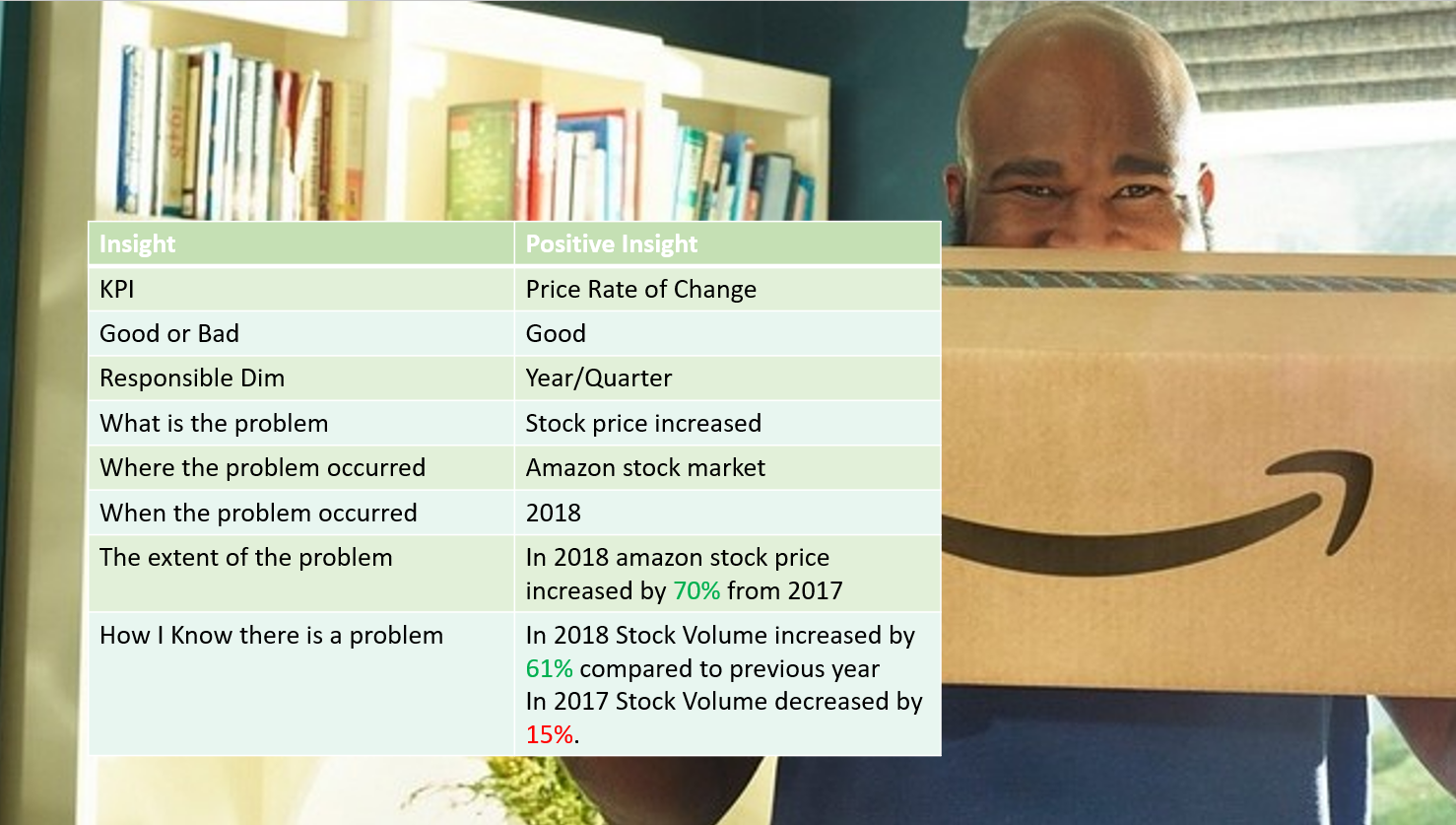

This analysis focuses on five KPIs - Gross Profit Margin , Revenue Year over Year, Revenue Quarter over Quarter Stock Price rate of change and Stock Volume rate of change

Role:

Problem Statement

Amazon has grown to become one of the largest companies in the world, both in terms of sales and market capitalization. But, with such a great size, comes a set of unique risks. The biggest risks of investing in Amazon stock are increasing competition, profit potential uncertainty, stock price uncertainty. Amazon operates with very narrow profit margins. Prior to 2019, the highest full-year net margin reported by the company was 3.7%, which was achieved back in 2009. Competitive pricing ensures Amazon’s gross margins stay within only a small range of modest values. Amazon’s management is committed to infrastructure expansion and growing investments in research and development, necessitating high operating expenses. For 2019, Amazon\\\'s profit margin rose to a record high, of just over 4%.

Next Steps

Suggestion/Recommendations

1. Considering Stock Split

Amazon has been one of the most impressive growth companies in history. I suggest considering stock split to make the stock more affordable and to attract individual investors. This will increase the demand and ultimately increase stock prices. The increased stock price shows the financial strength of the company.

2. Watch out the Competitors

Investors can easily shift to another investment when there is a better return on another investment. That will lead to decreased demand. If the demand is lower than the supply, the stock price will go down. One of Amazon\'s stock competitors is Walmart. In 2019, Walmart spent $215 million to match Amazon’s one-day shipping, while Amazon spent $800 million. Increased operating expenses cause a decrease in net profit. So, by watching the competitor\'s system Amazon should decrease the operating expenses.